From electric vehicles to electric vehicle batteries: A pivotal shift in focus of policymakers

– Nandan Kumar Singh, Milan Kumar and Prof. Nishant Kumar Verma

IIM Bangalore

Why India must take proactive measures to implement a robust battery policy focused on second-life applications to fully realise the potential of Battery Energy Storage System (BESS) products

emissions per vehicle are double those of IC engines. Image: Shutterstock

As the second-largest source of greenhouse gas emissions, the transportation sector accounts for 20 percent of global CO2 emissions, emitting billions of tons of GHGs annually. This impact directly challenges the goals set forth in the Paris Agreement, which targets a global temperature rise well below 2 degrees Celsius this century and aims for an even more ambitious 1.5-degree Celsius limit. In this context, electric vehicles (EVs) are emerging as a vital solution to help mitigate the sector’s carbon footprint and contribute to global climate goals.

The Role of Electric Vehicles

Governments worldwide offer subsidies for EVs under three main categories. First is consumer subsidy, aimed at reducing the cost of ownership and facilitating adoption. Second is a subsidy to promote capital expenditure in the sector, which includes two major avenues:

- Infrastructure subsidy for building charging stations to alleviate range anxiety; these subsidies are crucial for expanding route coverage through a network of charging stations and

- Tax exemptions/incentives to encourage scaling up the production of EVs.

Lastly, R&D subsidies target improvements in technology and production efficiency. A multi-faceted approach is essential for governments to address the value chain comprehensively.

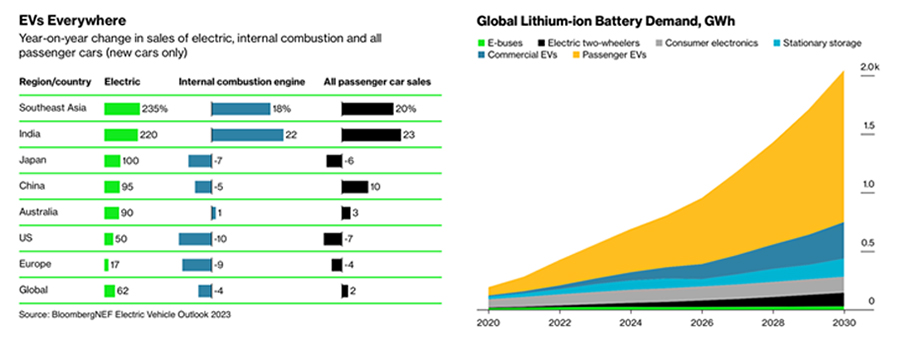

The initial emphasis on consumer and infrastructure subsidies has significantly spurred EV demand. This has consequently led to a rapid surge in battery demand (See Figures 1 and 2). As a result, challenges and opportunities related to electric vehicle batteries have moved to the forefront, necessitating focused government intervention and becoming the primary catalyst for shifts in EV policy.

Shift in Focus to EV Batteries

The reason for this transition in the focus of policymakers from EVs to EV batteries is due to several underlying reasons (See Figure 3)

1) Significant increase in demand for batteries: The entire lithium-ion (Li-ion) battery chain, from mining to recycling, could grow by over 30 percent annually from 2022 to 2030, reaching a value of more than $400 billion and a market size of 4.7 TWh. The sector requires stringent regulation and government support, as in the case of the European Union (EU) Battery Regulation to maximise economic benefits without environmental damage.

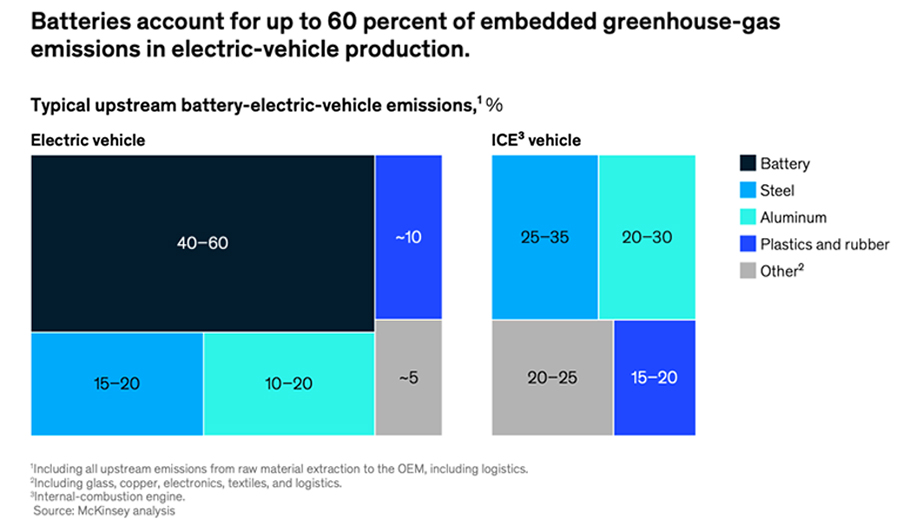

2) Emission associated with battery production: Although EVs are superior in lifecycle emissions, their material and manufacturing emissions per vehicle are double those of IC engines. Specifically, EV battery production is highly carbon-intensive, accounting for about 60 percent of total production emissions (see Figure 4). The government recognises this problem and is implementing regulations, such as the EU Battery Regulation and India’s Battery Swapping Policy (https://www.niti.gov.in/sites/default/files/2023-03/20220420_Battery_Swapping_Policy_Draft_0.pdf), aimed at enhancing the collection, reuse, and recycling of batteries. These measures seek to reduce carbon footprints, minimise harmful substances, and improve battery lifecycle management (BLM).

3) Maturity of EV battery second life application market: A promising development in the electric vehicle (EV) industry is the second-life use of EV batteries. However, two significant challenges exist in the second-life application market:

- The nascent state of second-life battery standards and the lack of guarantees regarding battery quality and performance and

- Immature regulation around the recycling and remanufacturing of EV batteries, creating uncertainty for Original Equipment Manufacturers (OEMs) and firms involved in repurposing.

Thus, policymakers are inclined to draft regulations around the standardisation of the battery and its second-life uses.

4) Battery recycling process and market: Policymakers are emphasising recycling to enhance sustainability and reduce the environmental impact associated with EV batteries. They are also offering research and innovation grants to advance recycling technologies. Initiatives such as the EU’s European Battery Alliance and the United States National Science Foundation Phase II Small Business Innovation Research grants are actively promoting these developments. In summary, regulatory incentives are crucial in fostering local recycling efforts.

5) Shortage of critical material: Batteries require a blend of raw materials, and the increasing demand for batteries across various sectors will lead to a corresponding rise in material mining. This could result in potential shortages of certain battery materials, posing challenges for companies and countries. To address these challenges, governments worldwide are developing policies to reduce dependence on specific materials. They are actively supporting research and development efforts for new battery technologies, including those involving advanced materials.

Source: Mckinsey

India’s Position and the Road Ahead

India has proactively recognised the central role of batteries in the overall sustainability of electric vehicles. NITI Aayog, the Government of India’s policy think tank, has introduced a Battery Swapping Policy. One key objective is to “Promote better lifecycle management of batteries, including maximising their use during their usable lifetime and end-of-life recycling.” Moreover, India’s EV vision now emphasises performance goals for EV batteries and actively fosters a Battery Development Ecosystem (BDS). This involves offering R&D support and grants for activities related to material modelling, new electrode and electrolyte synthesis, material characterisation, lab-scale prototype testing, and recycling processes.

In conclusion, India must take proactive measures to implement a robust battery policy focused on second-life applications to fully realise the potential of Battery Energy Storage System (BESS) products. Doing so will enable India to meet its ambitious goal of transitioning to 40 percent renewable energy by 2030 while addressing the energy needs of both urban and rural areas.

Furthermore, considering India’s heavy reliance on imported lithium-ion batteries—approximately 70 percent of its requirements are sourced from China and Hong Kong—it is imperative for the government to robustly support and actively promote the “Recycle in India” concept. This strategy is crucial for reducing dependency on foreign raw materials, especially in the context of geopolitical uncertainties. It will enhance both India’s energy security and its contributions to environmental sustainability and self-sufficiency.

Source: Forbes India