Indian Banks Battle Against Frauds

– Prof. Sankarshan Basu

Finance and Accounting, Indian Institute of Management, Bangalore

Reserve Bank of India (RBI) data reveal that about 34% of the frauds in the banking sector are internal and can be attributed to junior and mid-level questioning the integrity, credibility, survivability and processes of the banks.

The Indian banking sector has grown exponentially over the last three decades and associates with it, the

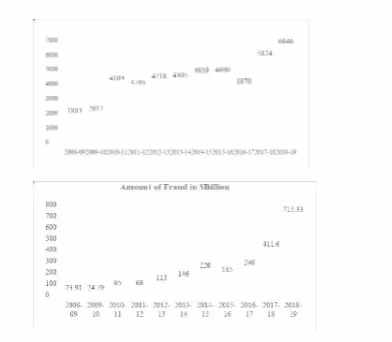

banking frauds have also shown a tremendous increase; for example, in 2018 – 2019 alone, 6646 fraud cases were reported amounting to $715.3 bn while size of the total banking sector was $2165 bn,

approximately 33%. Further, the issue is not just confined to one year – figures 1(a) and 1(b) highlight

the increase from 2008 – 2009. This is a serious problem of the Indian banking sector as it questions

the safety of the institutions and potentially shakes the very foundation and credibility of the system.

(Source: RBI, 2019)

Further, Reserve Bank of India (RBI) data reveal that about 34% of the frauds in the banking sector are internal and can be attributed to junior and mid – level questioning the integrity, credibility, survivability and processes of the banks.

The data makes it clear that one of the main challenges in the growth of banking in India is rising bank frauds and the costs thus imposed on the system – this has been highlighted by Gerard and Verschueren (2002); Nitsure, (2017); and Sharma, (2012) . Interestingly, the problem is not only for India, it is a global issue – the Global Banking Fraud survey by KPMG (2019) shows an increase of 19% in banking frauds between 2010 – 2015 and 2015 – 2019.

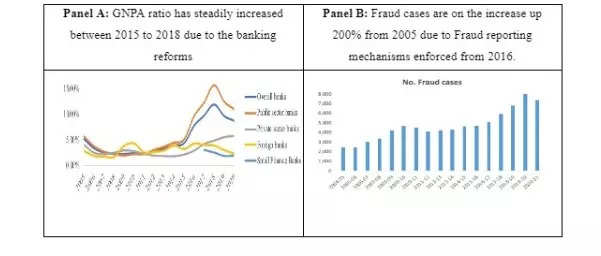

The Indian banking sector has undergone phase-wise reforms over the past five decades – the reforms involved bank nationalisation, bank liberalisation and allowing private bank participation, merging of Public Sector banks (PSBs) to protect depositor interest. However, poor lending practices and systems at the banks led to deterioration in asset quality, operational breaches and frauds. Figure 2 highlights the Gross NPA and Frauds across Indian banks between 2005 – 2020.

Frauds in the banking sector can be classified under four categories: Management, Outsider, Insider and

Outsider , and Insider. frauds. External frauds perpetuated by external customers impacts on bank

business and perpetrate fraud in the form of money laundering/fund siphoning, whereas frauds

perpetuated jointly by internal employees and external customer results in identity theft, loan / cheque /

mortgage / credit card /advance fraud, counterfeit instruments, money laundering etc. Also, wherever

higher management is involved in frauds, the fraud is carried out with the help of a financial statement,

asset misappropriation, corruption, and fraudulent misstatement.

borrowers or the depositors or both. It also leads to asset quality deterioration, but the level of

deterioration depends on the type of fraud – external or internal. However, the biggest damage that frauds

cause to the banking sector and Indian banks are no exception, is the damage to the depositor’s confidence

in the banking business (European Systemic Risk Board, 2015).

While the Reserve Bank of India has been taking a number of measures to address the issue of frauds in

the banking sector and it has also managed to clean up the segment to some extent, a long way is yet to be

traversed.

What this leads to is the possibility that frauds are increasing Operational risk costs and thereby reducing

bank profitability, thereby adversely impacting the banks financial health. Also, as stated above, the costs

are not just one time – some of them are long term costs (like loss of confidence)

Finally, Indian banks have to finetune their systems and processes better so that the fraud occurrences

reduce and or such instances are nipped in the bud. This will have multifaceted benefits for the banks and

the overall banking sector in India.

Source: The Economic Times